Annual Reporting: ESG is a question of showing off vs. showing real results

ESG surely is a hot topic. Across every industry, country and spread throughout your company’s annual reporting. But with great expectations comes great responsibility, and the balance between greenwashing and genuine effort on ESG is thin.

The Annual Report season has come to an end. Or so it could seem. Just as we’re done reminiscing over the year that has just passed, the scouting for upcoming milestones and touchpoints begins. Committed to learning from our experiences, we continue our 365-day journey of annual reporting. During the course of six articles, we’ll present our most essential takeaways regarding performance, purpose, ESG, exposure & opportunities, words & visuals, and format. Using our focus model — How key stakeholders prioritise content and communication in annual reports as our backbone. Here’s what to focus on when scoping your company’s ESG in the reporting season of 2023.

When reading through your annual report, investors, analysts, and key employees alike put great importance on ESG. But when it comes to assessing performance in these areas, investors and analysts, in particular, are concerned about the need for shared standards.

For the second year in a row, Simple Revolution and Kontrapunkt have asked the broad stakeholder landscape about their opinion on ESG reporting. The results are presented in the study Trends in Danish reporting vol.2 — Understanding key stakeholders, and it paints the picture that some scepticism exists.

“

I don’t think it is possible to measure ESG quantifiably at this point.

Venture specialist

Without shared frameworks that all companies follow, investors and analysts find it difficult to assess and compare commitments and performance within the ESG area. This leads to the belief among some in this group that ESG data is still too inconsistent to go by; that it can always be presented in a way that makes a company look good.

“

Right now, all companies can find a unit of measurement for ESG that can make even Exxon look environmentally friendly.

Analyst, M&A specialist

One way to go about it is to report on ESG in a separate report. That said, analysts, investors and employees agree on the positive prospect of integrated reporting as the ultimate goal. In whatever format you choose to portray your ESG efforts, factuality and transparency should be the spine that carries the message. Your stakeholders want to see how materiality issues are selected and anchored in your strategy and the frameworks you have in place to ensure you deliver on your commitments.

“

Sustainability should be an integral part of the company’s view of the world. I like to see a company make money, but not at the cost of the environment, people or ethics.

Employee

Team Lead

When reading your annual report, your employees want a holistic view of the company. Their notion of performance goes beyond the financial‚ it includes your ESG targets and achievements.

“

It’s easy just to reflect the figures. But I’m looking for inclusion of thought.

Employee, Head of global communications

ESG is vital for employees. And it’s crucial for the professional stakeholders as well, but they’re more concerned about the lack of one shared standard on the measurement of ESG. That’s not to say the employees are naive in reading the ESG reporting. They, too, have emphasised the importance of clarity and commitment to your ESG. And they want to see actions behind the words.

It’s time to tell about your ESG efforts, but committing and acting on them is more important.

Show it, don’t tell it.

Let’s exemplify it …

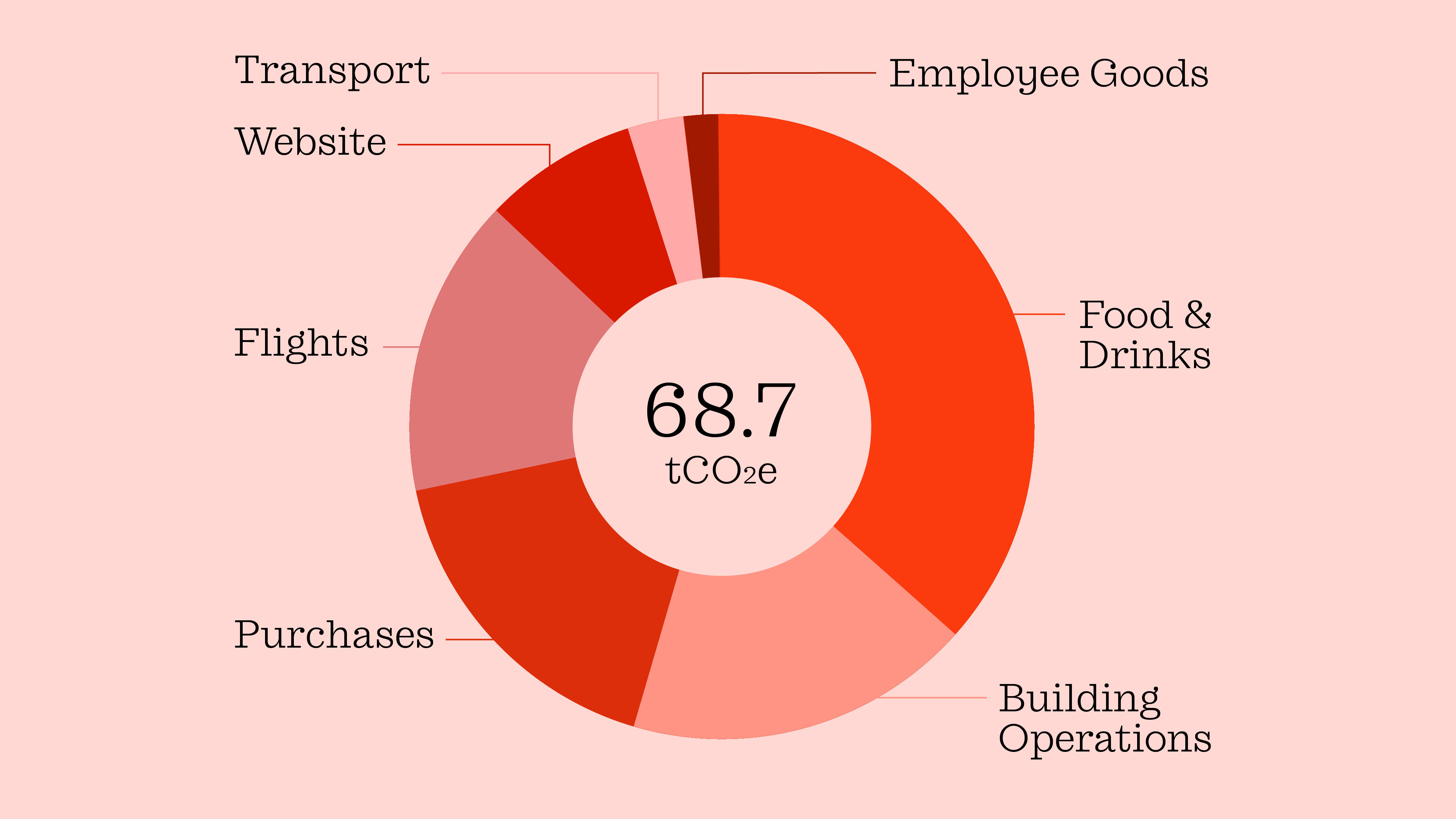

We've worked with 11 different companies crafting 8 annual reports, 2 integrated reports and 4 sustainability reports and a wide variety of other reports.

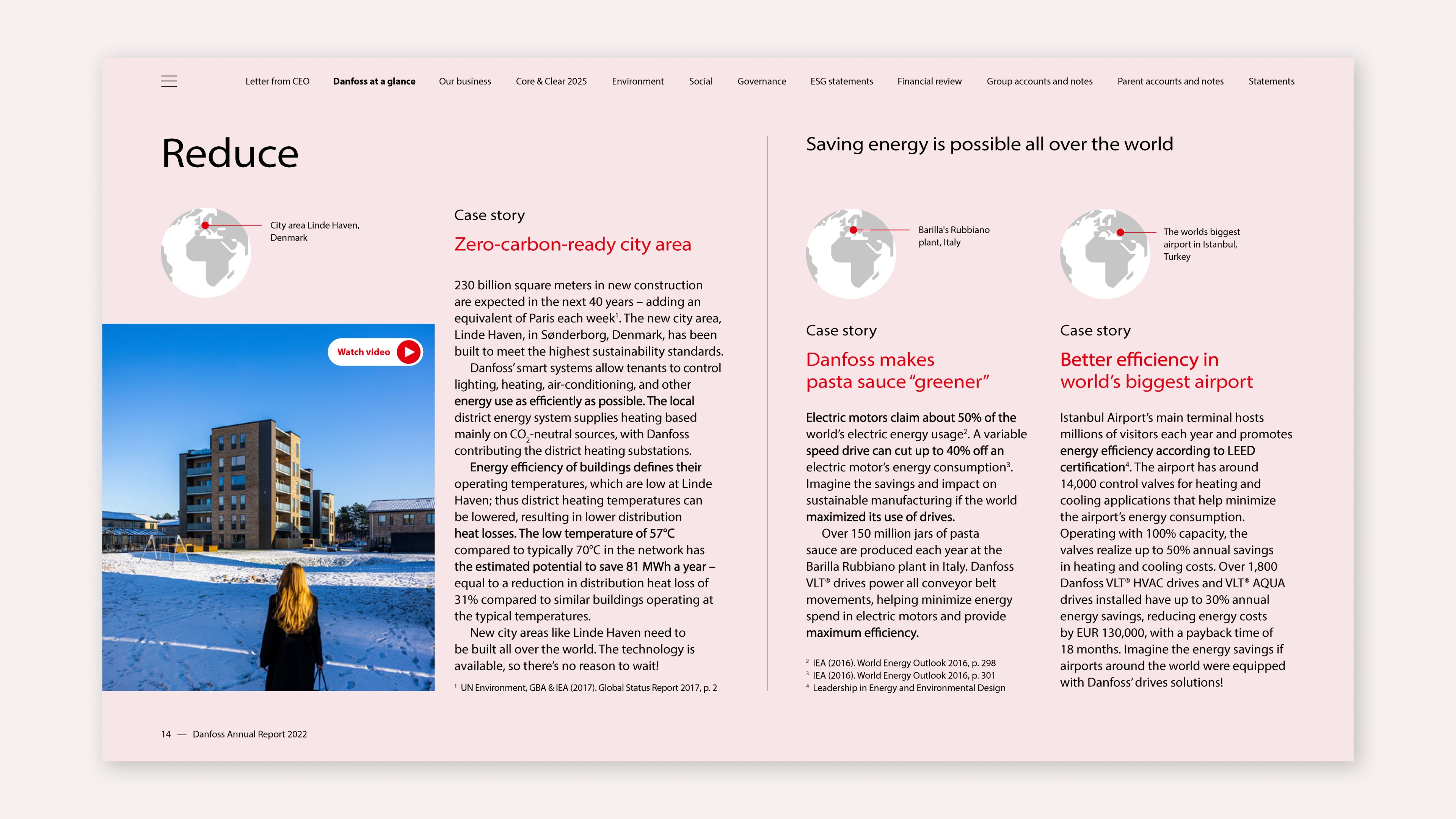

With the challenges our worlds face now, ESG is a hot topic — and for a perfect reason – in almost every annual report you can get your hands on. And it has been so for years. But the longitude of a topic doesn’t mean that a company can’t reinvent itself and take it a step further. Danfoss is an excellent example of this.

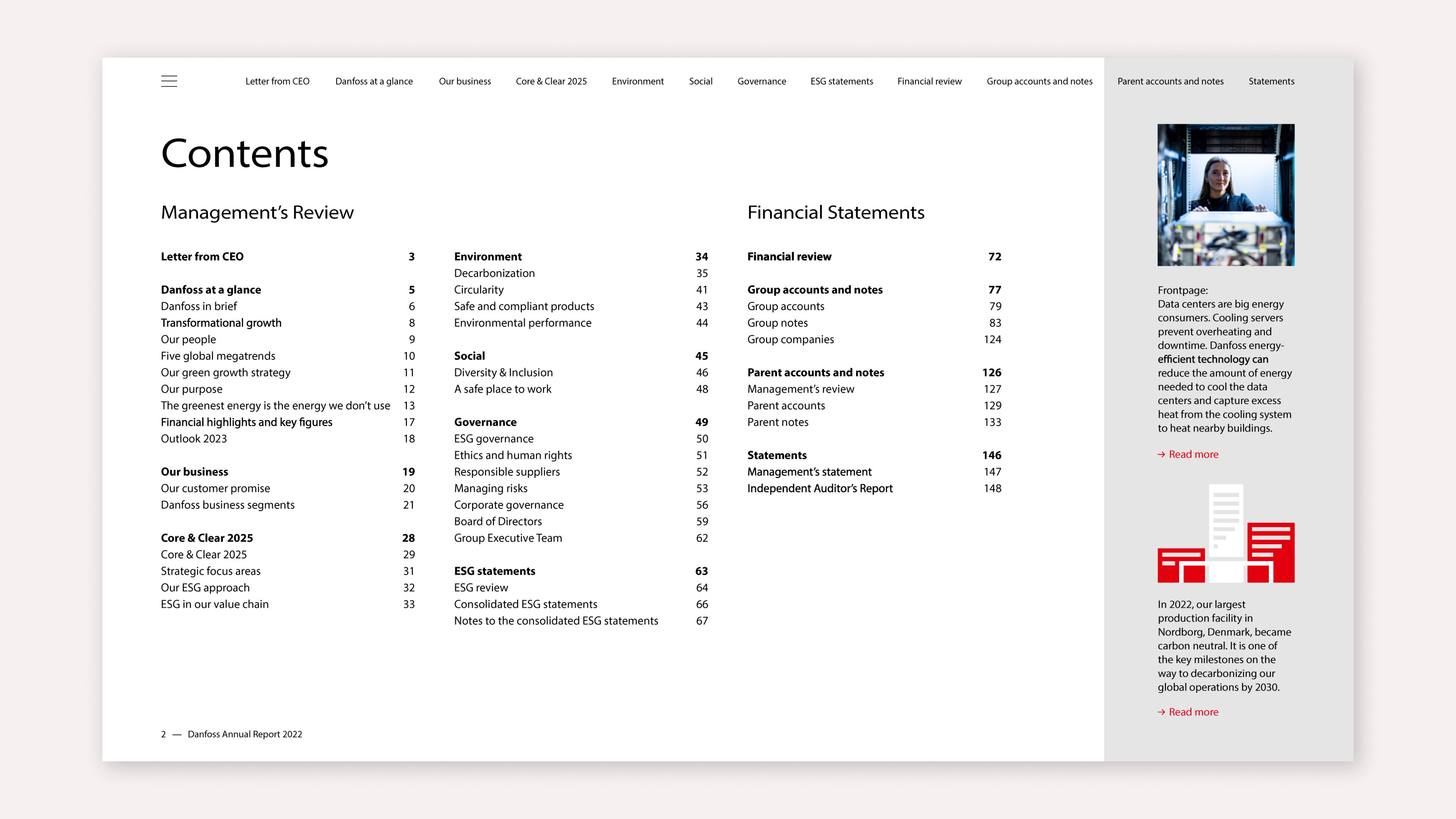

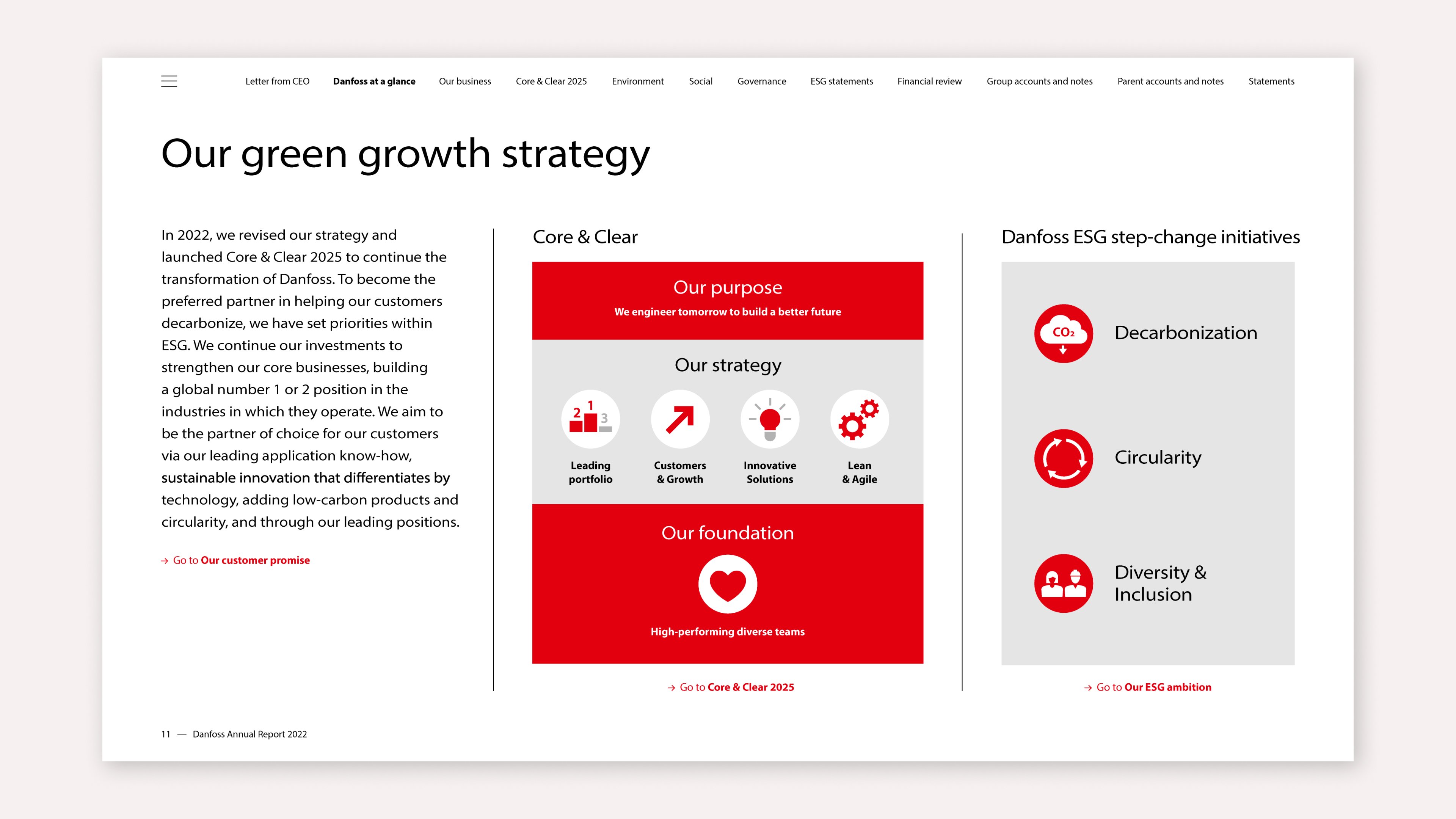

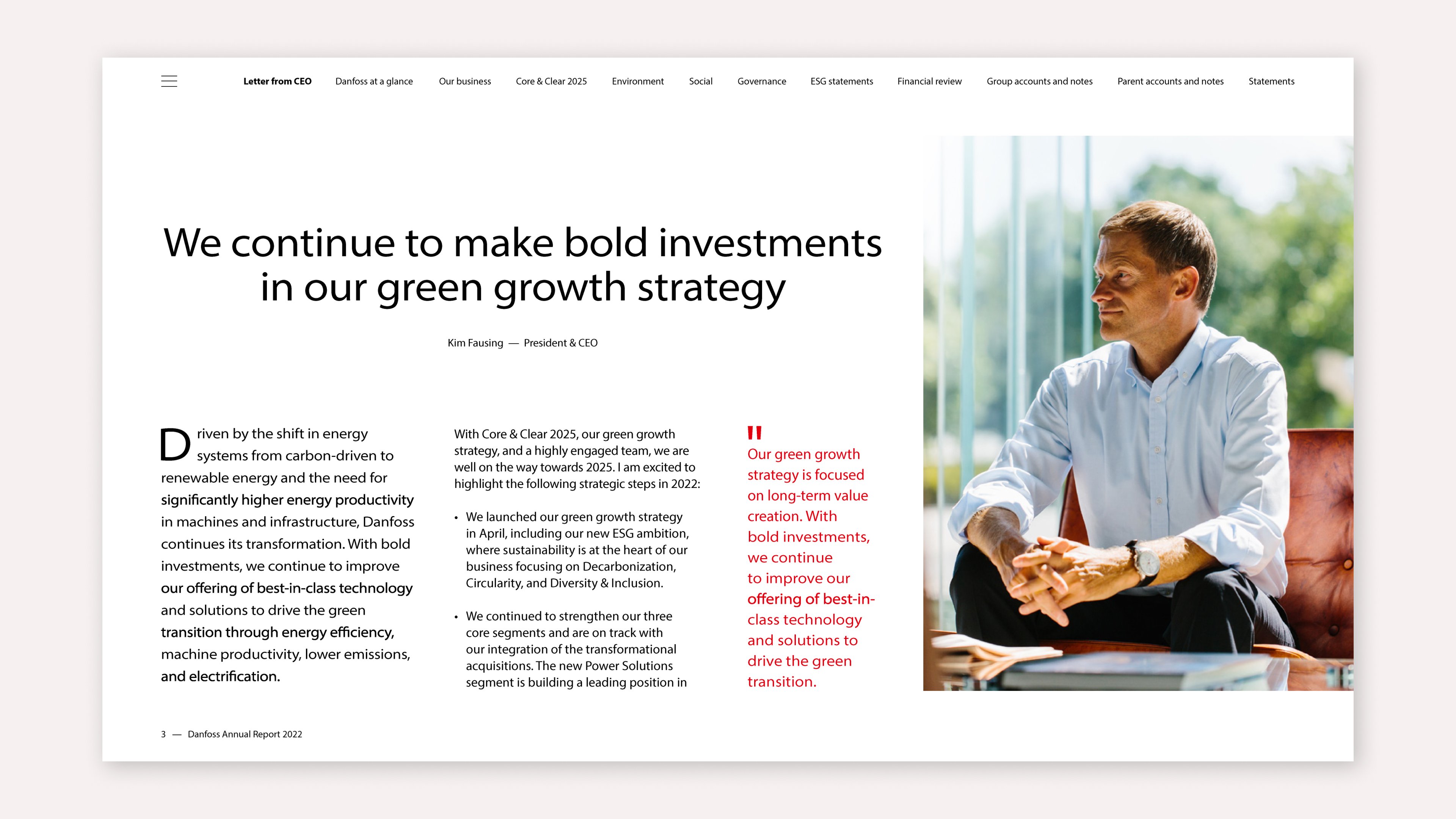

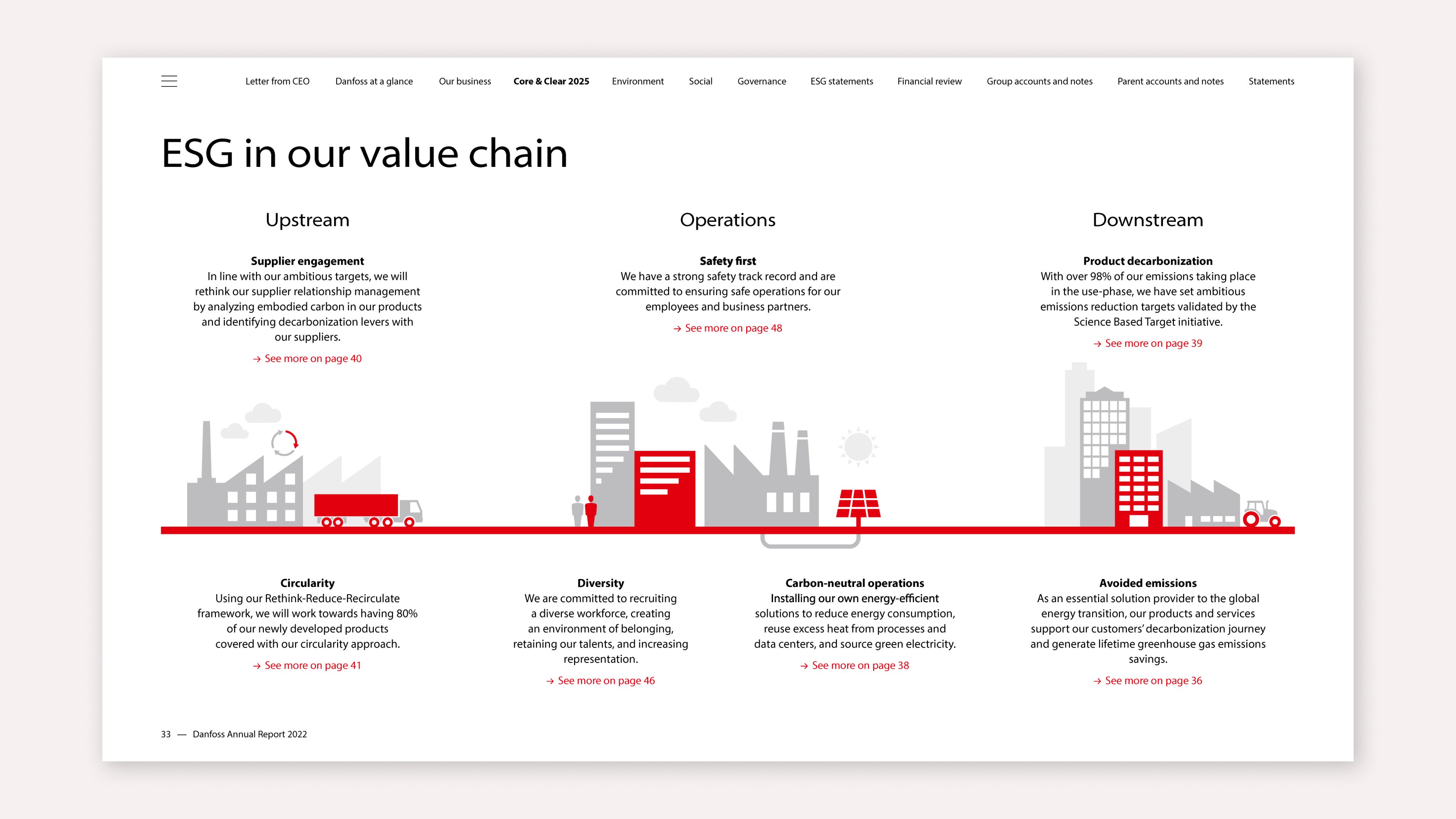

Danfoss excels in making a clear ESG structure the centrepiece of their integrated report. They do so by communicating about making investments with long-term value creation. The commitment to drive the green transition is a priority for the company as a whole. ESG is evident in their value chain and the cases Danfoss highlighted throughout the report.

/

In short

Environmental, social, and governance (ESG) factors have become increasingly important in the business world. These factors are often used to evaluate a company’s impact on the environment, society, and the overall sustainability of its operations. As such, it is critical for companies to include ESG information in their annual reports.

The emphasise on ESG is all around us, so to speak, whereas the entire landscape of stakeholders is increasingly demanding transparency and accountability from companies when it comes to their impact on the world around them. ESG matters when it comes to choosing where to apply for a job, purchase products and where to invest. By including ESG information in their annual reports, companies can demonstrate their commitment to sustainable practices and responsible corporate citizenship.

In addition, ESG information can provide valuable insights into a company’s risk profile and long-term viability. Companies that fail to consider ESG factors may be exposing themselves to unnecessary risks and limiting their potential for growth.

Finally, integrating ESG information into an annual report can help companies identify areas for improvement and set meaningful sustainability goals. This can ultimately lead to improved performance, increased stakeholder trust, and a more resilient business model.

ESG matters. Period.

Related stories